$500 million Google Pharmacy Ad Probe Settlement Should Have Little Effect

August 25th, 2011 by

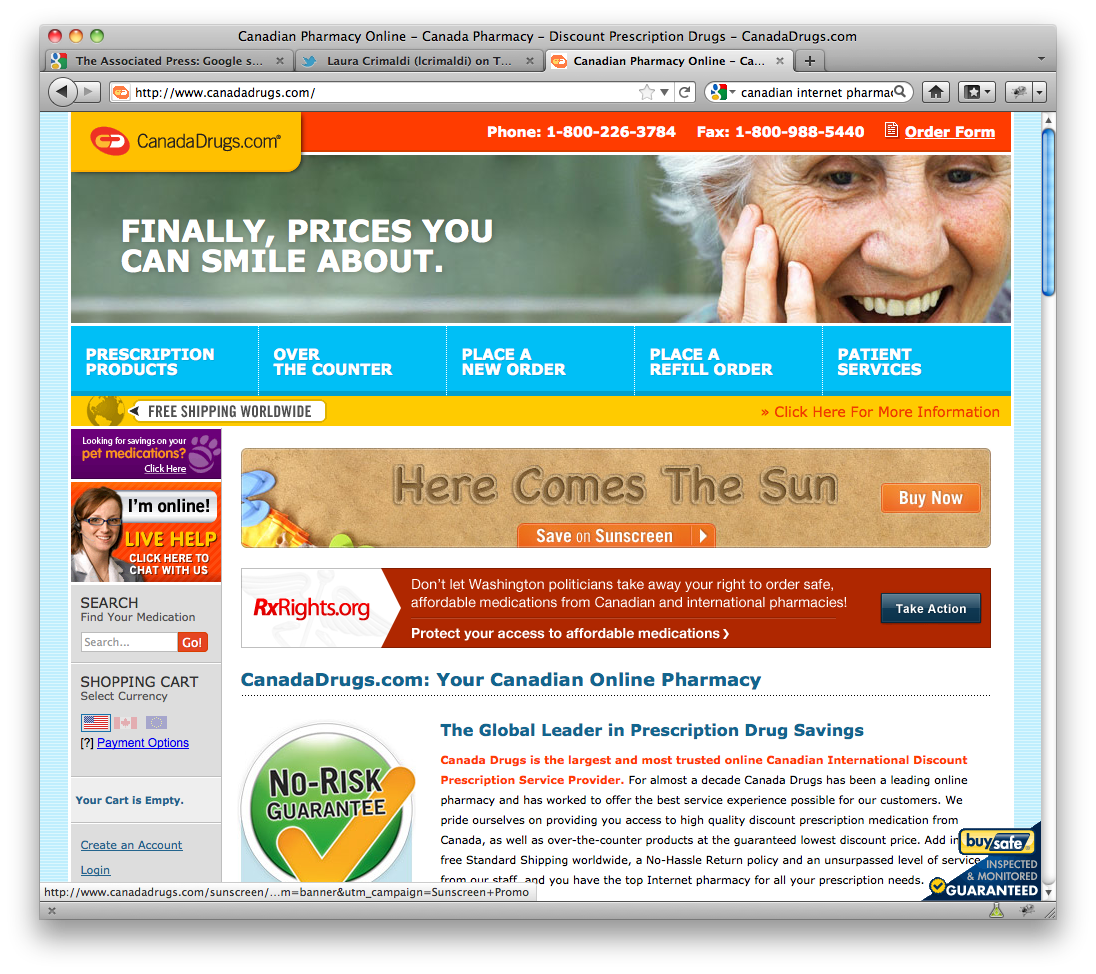

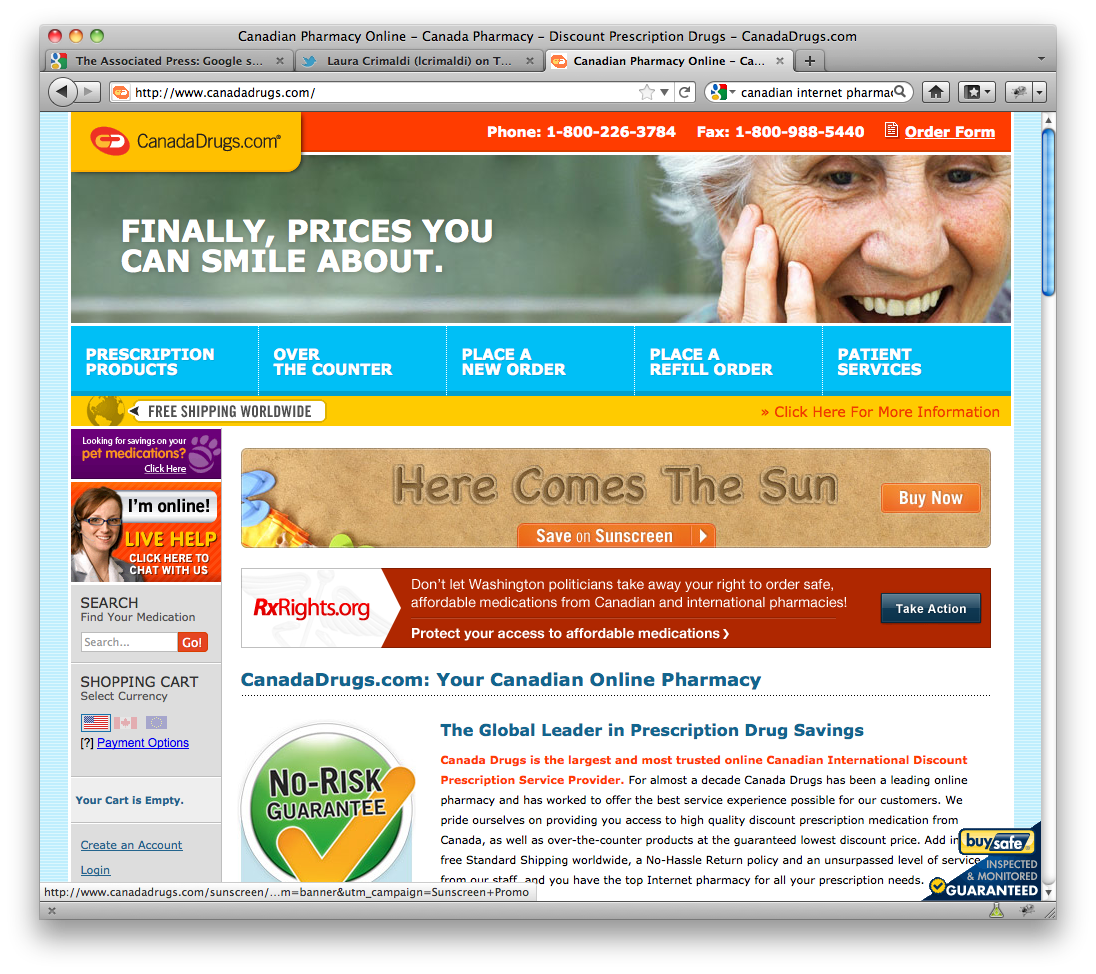

As expected from page 21 of the May 10 quarterly report to the SEC, Google will pay for a Department of Justice investigation into the use of American ad space for illegal Canadian pharmaceuticals. Finding that from 2003 to 2009, Google “both allowed and helped” Canadian pharmacies that tried to sell to US patients, this DOJ settlement avoids criminal prosecution. It’s also one of the largest forfeitures in US history, according to Rhode Island U.S. Attorney Peter F. Neronha. Crimaldi argues that Google may see long-term reputation damage from the case, which butts heads with the mantra of “Don’t be Evil.”

But is this backlash really going on? Google’s stock price was up $4.47 (.86%) on the day, despite Crimaldi’s piece coming out at 8am yesterday. Crimaldi predicted this by mentioning its miniscule amount compared to Google’s cash on hand; but not only this, the money has been paid for already. Google already mentioned it almost a year ago. The fallout for this may have already rippled the zeitgeist — May 10 began a 6-day slump, though not the nadir of a 3-month losing streak starting in April. Making comparisons even harder is the 5-day selloff that was likely a direct commentary on Standard and Poor’s downgrade of the company’s shares to “Sell.” S&P rated the stock a “Hold” yesterday, basically saying “the price is right.” Similarly, Robert W. Baird & Co. sees verticals like YouTube as undervalued, and sees the stock outperforming the market, even growing to $650 a share.

Three salient points arise from this story. First, there is a lot of trust in Google. The business world sees one of the main thrusts of European antitrust investigation as a boon to the company: the vertical integration Google has enacted. Secondly, Google isn’t the Dad and Dad store it was, even as recently as last decade. Google’s revenue has exploded by 33% over the past fiscal year, in no small part due to the Adsense/Admeld deal. Finally, Google has often toed the line of what is or isn’t legal — for a less objectionable example, look at Google’s reticence to Chinese censorship laws.

Peter F. Neronha, sending "a clear message to... Google and to others that contribute to America's pill problem that they will be held to account."

Most importantly is that this has already been planned for and dealt with. The submitted Form 10-Q says:

In May 2011, in connection with a potential resolution of an investigation by the United States Department of Justice into the use of Google advertising by certain advertisers, we accrued $500 million for the three month period ended March 31, 2011. Although we cannot predict the ultimate outcome of this matter, we believe it will not have a material adverse effect on our business, consolidated financial position, results of operations, or cash flows.”

Google still allows American pharmacies and pharmaceutical companies to advertise on Adwords and Adsense, though under much stricter rules. Clearly, neither Google nor its handlers are concerned about this, and neither should anyone with a vested interest in the company.