What’s the REAL Organic Search Market Share?

November 3rd, 2011 by

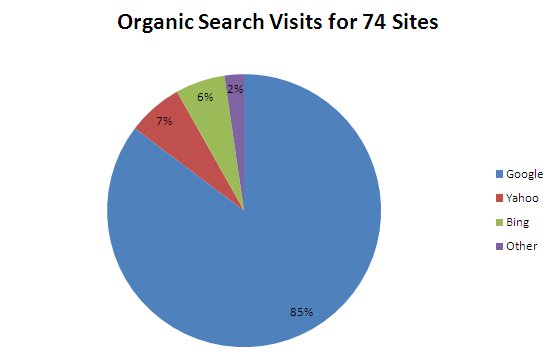

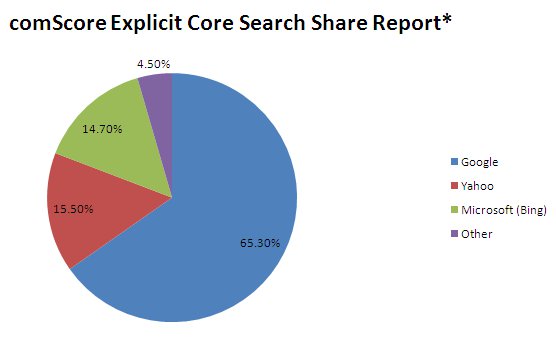

If you work in interactive marketing, you’re are probably familiar with comScore and its monthly estimate of the United States search market share that consistently looks like the following graph, reflecting data collected September 2011. It’s safe to assume that these numbers apply to the websites that you promote as well, right? Not really.

For the past few years, it seems like every dataset that I’ve seen contradicts these market share reports, so I decided to dig a little deeper and see what I can find.

comScore’s numbers:

comScore is extremely thorough in its calculations. It obtains this information by installing software on the devices of a large number of paid users, which tracks and records all the searches performed on that device. In the month of September 2011, the company recorded over 17 billion search results. It claims to get data from a variety of users that is representative of the market share of major ISPs in the U.S., but other than that, I’m not sure how they pick users. Either way, 17 billion intuitively seems like a big enough sample to come to firm conclusions.

My Tiny, but Interesting Dataset

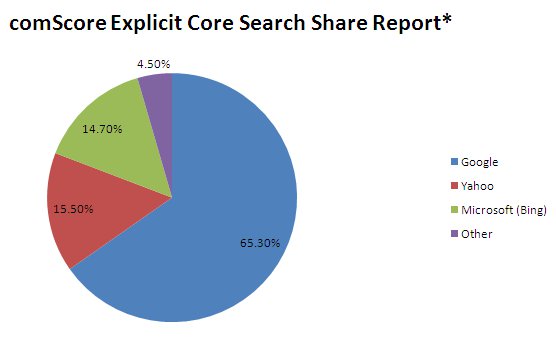

To find numbers that I thought would be representative of the search engine market share for our clients and sites, I created a custom report in Google Analytics that provides the number of site visits from organic searches, and breaks them down by each particular search engine, over the last month (10/2/11 – 11/1/11). To figure out which sites to use, I exported data for the first 75 sites I found that I was certain were active and received organic search visits. The total number of visits was approximately 350,000, so it’s a relatively small sample. There was one site that I excluded because its total visits exceeded all other sites by 3!

As you can see in the chart, Google searches account for a whopping 85% of the organic visits! Like the comScore data, Yahoo and Bing are about even. This is pretty amazing, right? Even though these numbers are too small to make comparisons to the U.S. market share as a whole, the information is representative of Search Influence clients and therefore important to us.

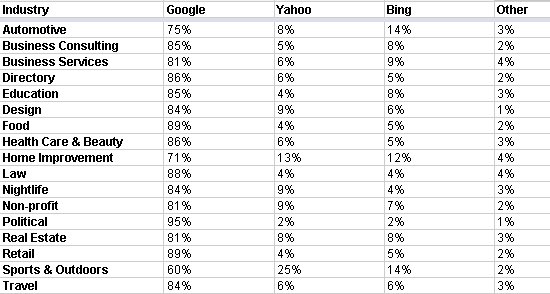

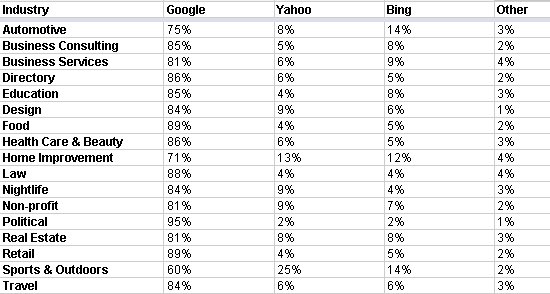

Industry Segments

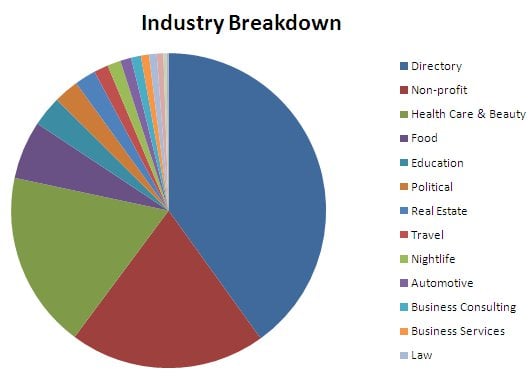

Most of the sites we looked at are small businesses throughout the country. 40% of the results come from 2 medium sized yellow pages directories–but when you take these two sites out, the share is virtually the same. We also see big numbers from Health Care & Beauty and Non-profit. The Non-profit is actually one large organization and the Health & Beauty segment is mostly composed of dentists and plastic surgeons. Two of the sites included are informational sites that attract national visits. Those two sites alone, which represent about 1% of the total visits in this set, received on average 94% of their organic visits from Google.

Why the Numbers are Different

The numbers differ for many possible reasons, but none that I have been able to completely pin down. Obviously the set of websites used here is not representative of sites on the Internet as a whole. Another reason could be that Google inaccurately reports referrals from other search engines, or perhaps small businesses rank better on Google, so our small business clients get more visits from Google. Another factor may be that none of these sites target American users that search in a language other than English. Whatever the case may be, it’s obvious to me that Google has an even bigger impact on our small business clients than the comScore numbers suggest.

What about you? Feel free to share your data, do a similar study, speculate on these results, or tell me why I’m full o’ bull.

Oh, and if you’re interested in a more detailed breakdown of the results in a particular industry, here it is. Here is a link to the spreadsheet.

Awesome post, Scott.

I’ve definitely read that Google might not report Bing and Yahoo hits as well as it could [citation needed].

But I think the strongest case might just be demography. The fact that Yahoo is higher than Bing in some cases, and that there’s a site that has over 30% of its visits from not-Google makes me think that the visitors simply are either new internet users (who don’t have the same brand loyalty as someone who grew up with Google, and might be more swayed by traditional advertising like Bing’s) or older users (who still have brand loyalty for Yahoo or something, despite whatever’s been going on there).

What this also highlights is the weakness of the ComScore numbers, which includes non-search searches for Bing and Yahoo, including things like internal searches on the MSN network, which boosts Bing’s usage in ComScore but not actually for organic searches. I’m also curious about how they could count “powered by Google” and whatnot, like AOL search.

People, and Doug, sorry but I forgot to include a link to comScore’s original data, which actually includes AOL. Here it is: http://www.comscore.com/Press_Events/Press_Releases/2011/10/comScore_Releases_September_2011_U.S._Search_Engine_Rankings.

Doug, I feel like Bing is big with the 50+ crowd and have no idea why I feel that way other than my dad was really excited about the launch of Bing for some reason. Maybe the advertising and cool home page pictures does something for them–who knows.

It would be cool if someone found an alternate study, particularly from an SEO or Local SEO.